Wall Boulevard’s religion within the synthetic intelligence growth that has powered US equities markets to document highs will probably be put to the check on Wednesday when $4tn chipmaker Nvidia unveils its hotly expected quarterly income document.

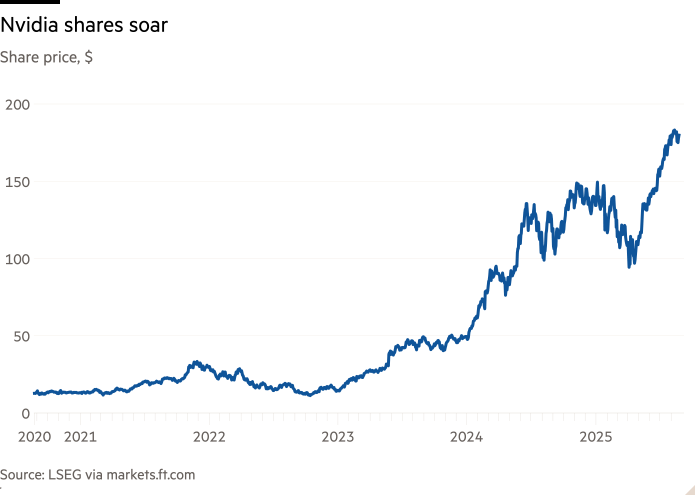

Nvidia, the arena’s most dear public corporate, has surged by means of greater than 30 in step with cent this yr, turning into the primary staff to achieve $4tn in marketplace price. It’s been an important contributor to the S&P 500’s 9 in step with cent upward push in 2025 as a result of its mammoth marketplace price.

Buyers are making a bet that enthusiasm surrounding fast developments in AI, which has additionally boosted firms corresponding to Microsoft, Amazon and Palantir, will proceed to be a dominant issue within the coming years.

“It’s no longer only a unmarried inventory,” mentioned Arun Sai, multi-asset portfolio supervisor at Pictet Asset Control. “It’s very atypical — other folks learn via it to the financial system as an entire.”

Nvidia’s income come at a time of rising fear over the lofty valuations of businesses tied to AI. The tech-heavy Nasdaq 100 index is buying and selling at about 28 occasions anticipated income over the following yr, smartly above the 25-year reasonable of twenty-two occasions, with Nvidia lately buying and selling at about 40 occasions its anticipated income, FactSet information presentations.

Tech shares fell final week, as a dismal document from the Massachusetts Institute of Era and feedback by means of OpenAI leader Sam Altman solid doubt at the sector’s months-long surge.

Many marketplace members are viewing Nvidia’s income document, due after the last bell on Wednesday, in the similar vein as blockbuster financial experiences that continuously sway markets.

“It’s no longer simply that Nvidia is a huge keeping,” mentioned Jon Zauderer, head of North The usa specialist gross sales at Citigroup. “They’re the locomotive of this AI teach. There may be such a lot scrutiny in their messaging.”

Daniel Newman, leader government of The Futurum Staff, a analysis corporate, echoed that sentiment, announcing “an sudden marvel” — a transparent leave out on both earnings or steerage — “will be the final and quickest option to ship the marketplace right into a tailspin”.

Nvidia’s greatest consumers, Microsoft, Google, Meta and Amazon, have signalled in fresh weeks that they plan to speculate large quantities in AI infrastructure, with spending heading in the right direction to achieve $350bn this yr.

Nvidia makes graphics processors which might be extensively used to coach fashions that underpin merchandise corresponding to OpenAI’s ChatGPT and Google’s Gemini.

Analysts be expecting Nvidia to document $46bn in earnings for its July quarter, in keeping with a FactSet ballot. Marketplace expectancies have climbed regularly since June, because the tech sector’s multi-month positive aspects have additional lifted hopes for Nvidia’s efficiency.

If analysts’ predictions end up to be proper, that will put earnings enlargement at 53 in step with cent year-over-year, robust for a big, established corporate, however nonetheless a drop from the former quarter’s 69 in step with cent and smartly beneath the greater than 250 in step with cent recorded in early 2024.

Joseph Moore, a semiconductor trade analyst at Morgan Stanley, mentioned markets will have to no longer be overly focused on the slowdown in earnings enlargement.

“Other people will probably be extra all for enlargement relative to friends, and presently they’re doing really well in that regard. The marketplace is happy with the place they’re from a enlargement perspective,” he mentioned.

Any other issue that will probably be watched intently by means of analysts is Nvidia’s outlook for the China AI chip marketplace. An unconventional care for the Trump management previous this month noticed Nvidia comply with pay 15 in step with cent of gross sales to the federal government in alternate for a licence to promote its watered-down H20 chips in China.

However the corporate has to navigate a political backlash in opposition to the chips in Beijing, in addition to mobilise its provide chain to start out generating them once more at quantity.

“You by no means know the place expectancies are [around Nvidia] — normally the whisper numbers are upper,” mentioned Stacy Rasgon at Bernstein, pointing to a phenomenon the place buyers be expecting numbers which might be other from Wall Boulevard’s consensus forecasts.

He added that whilst China chip gross sales were a slightly small fraction of Nvidia’s earnings previously, and feature been phased out of its steerage in the interim, “buyers will probably be asking: are they in truth making stuff for China, or are they no longer?”

Sturdy effects have no longer at all times translated into robust returns for shareholders, or huge optimism for the marketplace.

After Nvidia beat the marketplace’s expectancies for benefit and earnings in February, the inventory dropped 8.5 in step with cent the next day.

The ones effects got here at a time when markets have been uneasy about developments by means of China’s DeepSeek, which claimed to reach identical efficiency to US opponents however with more cost effective chips.

“At those valuations, each issues topic: the macro outlook and Nvidia’s personal efficiency, or the micro,” mentioned Moore at Morgan Stanley. “[In February] other folks have been wondering the macro and micro stipulations . . . [but now] it will have to be an overly robust outcome.”